The 2017 Cost vs Value Report by Hanley Wood Products was recently released.

One of the enlighting points in the report is how much the costs change based on geography.

Now, everybody knows that the cost of good and services change depending on the location.

So the challenge for any homeowner wanting to build value in their home is to find a way to keep

the cost down as much as possible. For most families that translates to a little sweat equity.

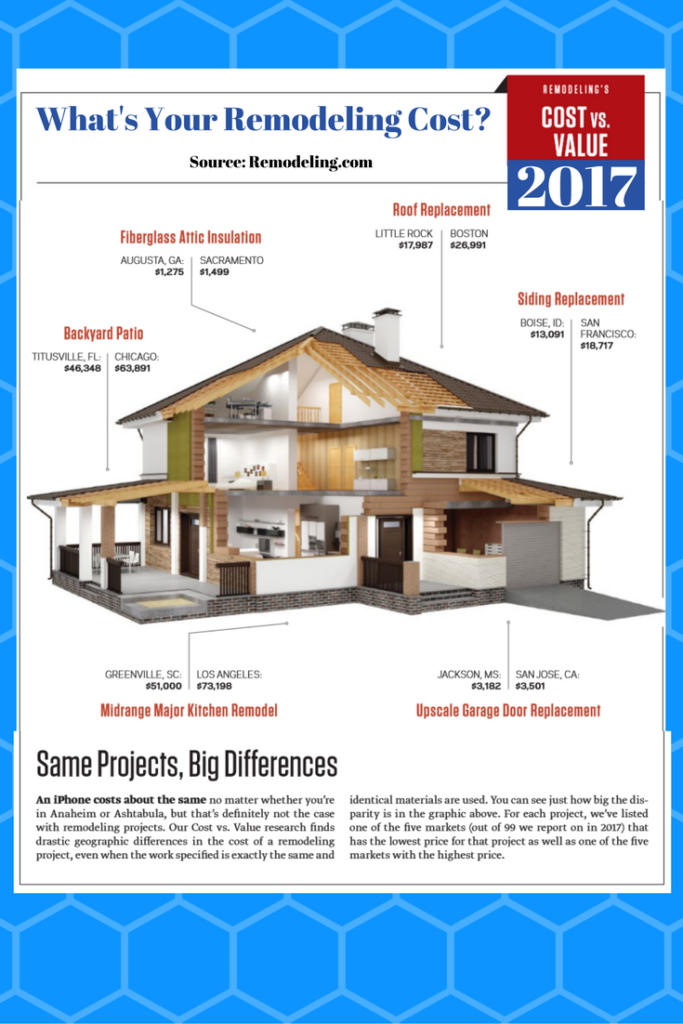

This graphic show some of those differences. The caption from the 2017 Cost vs. Value Report states:

“An iPhone costs about the same no matter whether you’re in Anaheim or Ashtabula, but that’s definitely not the case with remodeling projects. Our Cost vs. Value research finds drastic geographic differences in the cost of a remodeling project, even when the work specified is exactly the same and identical materials are used. You can see just how big the disparity is in the graphic above. For each project, we’ve listed one of the five markets (out of 99 we report on in 2017) that has the lowest price for that project as well as one of the five markets with the highest price.”

IF you’re wanting to build value in your home, so you can build your community, and also take advantage of the Tax Relief Act of 1997

your going to have to pay attention to details, and put in some sweat equity.

Your rewards can be substansial.

Our friends over at Trulia.com put it this way:

“The Relief Act allows sellers to sell their property as long as they have lived there for 2 of the last 5 years and take advantage of this tax relief. For single individuals, they can realize up to $250,000 in capital gains TAX FREE.

For married couples, it is $500,000. There is no requirement to roll these proceeds over to a replacement home, so a seller can take this money and go on a cruise around the world if they so desire.

Additionally, there is no limit to the number of times you can use this exemption. You just need to make sure you have lived in the home as your primary residence for two of the past five years.”

We call this process Home Value Optimization!

You see, the value of your home is a tremendous assett. With a little planning you can you protect and grow that asset, build your community, and eventually own your dream home free and clear.

Can you afford to blindly hope that the value of your home is going to increase over time?

Or would you rather build that asset and make it work as hard as you do?